Apple soaks Google to sit in Safari’s sweet spot

By Ed Hardy •

Photo: Ed Hardy/Cult of Mac

With sales of iPhones plateauing, money from its Services sector is playing an increasing role in Apple’s bottom line. There’s a significant source of this type of revenue many might not expect: arch-rival Google.

As part of its advertising business, Google pays Apple a huge sum every year to stay the default search engine in the Safari web browser. And it’s expected to grow.

Google pays through the nose

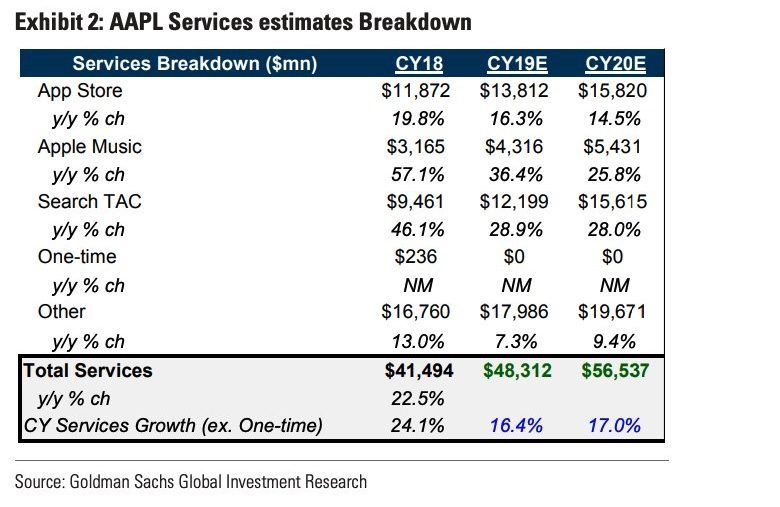

That payment was $9.46 billion in 2018, according to Todd Hall, an analyst at Goldman Sachs. This traffic acquisition costs (TAC) made up 20 percent of Apple’s entire services revenue last year.

“Not only is TAC large but it is still growing as people search more on mobile devices,” said the analyst. He predicts it could grow to $12.2 billion in 2020, and $15.6 billion the following year.

This causes something of a dilemma for Apple. The iPhone maker criticizes Google’s business model of collecting private details about users and selling them to advertisers, but Apple also profits from it.

Create an “Apple Prime” subscription

With the phone market increasingly saturated, the days of annual double-digit iPhone sales growth are likely over. Pleasing investors will require growth in other areas, including in Services. Todd Hall suggests that Apple bundling its services into one subscription would help grow its services revenue. “We expect Apple to launch an ‘Apple Prime’ type package in late March,” said Hall.

This could be a single monthly fee for access to iCloud storage, Apple Music, the Apple TV streaming service that’s rumored to launch this year, as well as upcoming news and games subscription services.

Increasing income from the App Store

Apple is seeing growth from other parts of its services business. Revenue from software sales was up 36 percent last year, part of a long-running trend in this area.

And Goldman Sachs sees growth from Apple Music, too. All this will lead to significant increases in this sector for several years.

Chart: Goldman Sachs

Recent Comments