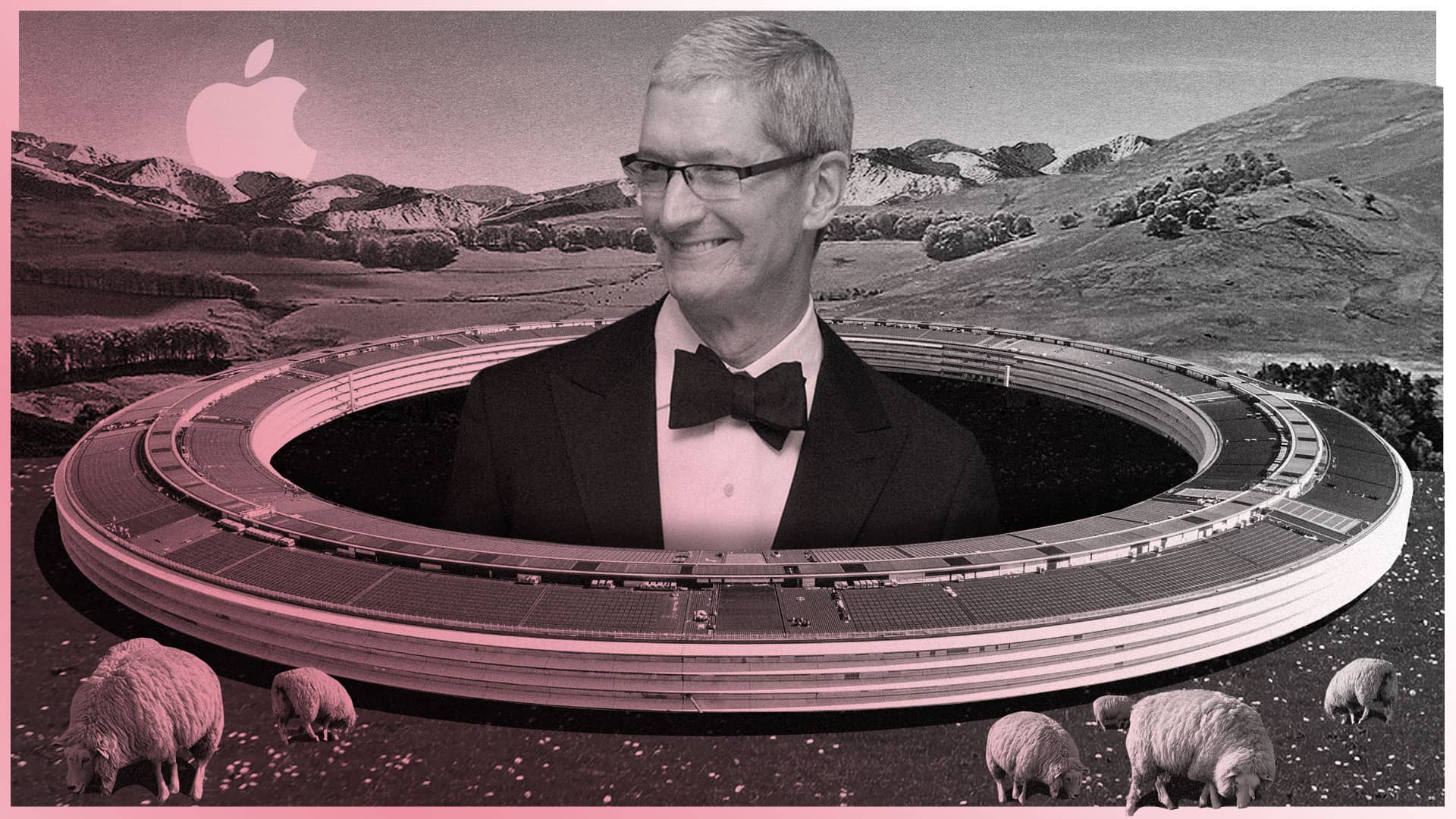

Apple will lay details of its metamorphosis from an iPhone company into a hardware + services company Monday. Ahead of the star-studded “It’s Showtime” event, The Wall Street Journal has published interesting tidbits surrounding the company’s upcoming new subscription services.

iPhone is running out of juice

The Wall Street Journal today ran an article reveals that Cook began banging the services drum soon after the November 2017 launch of the tenth-anniversary iPhone X that arrived with the then unheard-of price point of $1,000.

By then, concerns had already been rising inside Apple about the iPhone’s future. The number of devices Apple sold was growing more than 20 percent annually as Mr. Cook pushed it into new retailers and markets, but sales executives told colleagues in 2014 they were running out of avenues for easy growth, former employees said. ‘They were freaked out,’ one person said.

Revenue went up but until sales dropped, prompting Cook to begin meeting regularly with the Services division headed by Eddy Cue.

The meetings were intense:

At the monthly sessions, the 58-year-old CEO has peppered the team with detailed questions. He wanted services team members to tell him which apps were selling well, how many Apple Music subscribers stuck with the service, and how many people were signing up for iCloud storage, a costly service that required spending billions of dollars to build data centers around the US, according to people familiar with the meetings.

“You couldn’t say, ‘I don’t have that information. I’ll get that tonight,’” said a source. “You had to have a dictionary of backup.”

That certainly sounds like Tim Cook.

Beyond iPhone

CEO Tim Cook established a post-iPhone strategy back in 2014. Apple’s ambition in video is to become an alternative to cable.

TV service

Apple’s share of digital movie sales and rentals was more than 50 percent in 2012, but by 2017 it had fallen to between 20 percent and 35 percent. In 2015, Apple contemplated acquiring Disney or Netflix, and building its own studio.

Here’s the exact moment that convinced Cook to invest in video.

During a presentation before the launch, the music-streaming team told Mr. Cook they expected to generate more than 10 million subscribers in the first year. ‘Double that,’ said Mr. Cook, according to a person familiar with the meeting.

The executives ended up easily clearing the goal, which encouraged them about Mr. Cook’s vision for the opportunity in services, the person said. Mr. Cook and Eddy Cue, his lieutenant in charge of services, started looking for other subscription opportunities.

Video was an immediate priority.

Apple reportedly wanted a service that could “beat Netflix.”

The upcoming product should combine original series with shows from other networks, potentially reaching more than a hundred markets worldwide.

On the discussion with Hollywood studios:

Apple executives made clear during talks with TV makers that it needed as broad a reach as possible to compete with Netflix and others. Last year, Apple announced a similar agreement with rival Amazon.com Inc. to bring Apple Music to Echo smart speakers.

‘We made a mistake with Apple Music, thinking we could go it alone, and it took a long time to catch up. We still aren’t there yet,’ the head of marketing Apple services, Jon Giselman, said during a meeting with one of the company’s partners, according to a person in attendance.

Monday, Apple will unveil the first footage from some of its new original TV shows.

Channel subscriptions

Apple will also sell subscriptions to channels like Starz, Showtime and HBO. The channels could be offered as an option for $10 per month each.

The new TV app

The original shows will be distributed via a new TV app, which staff have been calling “a Netflix killer”. Apple may put the TV app on multiple new platforms, including Roku and smart TVs beyond Samsung, with some of those distribution agreements likely to be mentioned Monday.

News subscriptions

Apple will show off a revamped News app with a new $10 per month subscription option with access to more than 200 magazines. That service is based on Apple’s acquisition of the all-you-can-eat magazine subscription service Netflix. Some of the available titles will include magazines like Bon Appétit, People and Glamour, as well as newspapers like The Wall Street Journal.

Here’s how the Journal framed its own participation in the service

As part of the arrangement, much of the Journal’s content will be available through the service, although certain types of stories—particularly general news, politics and lifestyles news—will be showcased, while business and finance news won’t be displayed as prominently.

The deal will result in the Journal hiring more reporters focused on general news to help feed Apple’s product, one of the people said. The Journal sells its own subscriptions for $39 a month.

Curiously, the Texture deal reportedly gave Apple rights to most major magazines for at least five years. Moreover, Apple also scored up to two decades in an agreement that splits revenue 50-50 between it and publishers such as Hearst Magazines and Condé Nast.

The New York Times and The Washington Post opted out.

Tidbits

Apple is keeping a close eye on the top-performing App Store apps.

For Mr. Cook’s monthly services meetings, the company has intensified monitoring of apps that benefit and threaten Apple. The team has created a release radar for the CEO to track apps that are expected to sell well and other metrics for the apps that have challenged Apple’s business, including iTunes sales decreases compared with Apple Music subscription growth, said the person involved with the meetings.

Despite earlier reports, Apple’s new services won’t be free:

Other successful subscription apps have given away much more content at lower prices than Apple is expected to offer initially. Amazon Prime members, who pay $119 annually, get free video content and discounted music subscriptions.

Some inside Apple’s services group wanted similar benefits for iPhone buyers. Mr. Cook and his leadership team have made it clear that its forthcoming services will carry a price tag.

Last but not least, the article mentioned that App Store subscriptions now represent 47 percent of sales, excluding games. Games still account for nearly three-quarters of App Store revenue, for those wondering.

What do your think about Apple’s pivot to services.

Let us know by leaving a comment below.

Recent Comments